Systemic Financial Racism Requires Greater Insights And Smart Tools To Build Black Wealth

|

| Photo Credit Christina at Upsplash |

By Kamau Austin, Publisher Scoop Publications

In June, 2022 a compelling meme circulated on Facebook alluding to the 400-year head start whites have over Blacks in the US economic system. It was ironic in that it was being shared in a Black group on a social media platform with a leaning towards conservative "pull yourself up by your own bootstraps" types. Even Black conservatives, like others in the society, too often regurgitate the usual ole tropes about Blacks.

For instance the following are some stereotypical tropes perpetuated by Black conservatives or financial coaches about the lack of Black financial success:

- Blacks can't achieve financial literacy because we're trying to achieve acceptance with consumerism.

- Blacks don't achieve wealth because we don't understand investments and buy real estate.

- Blacks aren't knowledgeable or disciplined in terms of credit.

These tropes, while having some truthful claims about some Blacks, puts the onus of the present inequality in wealth concentration between whites and Blacks squarely on clueless or undisciplined African Americans. These stereotypes side step the fact Blacks, in the past and presently, are fighting systemic economic racism, marginalized business ownership, and industry isolation.

It should be obvious individuals can't beat systems by themselves so financial literacy should evolve beyond just having insights on getting a mortgage, Debt to Income (DTI) ratios, and investing in stocks and bonds. Financial literacy for Blacks should also extend to new technical tools, political, social, and economic advocacy to gain more economic empowerment and collective wealth creation.

Timothy Griggs, a Black real estate investor and mortgage broker is extremely concerned about Blacks and other financially marginalized people getting access to wealth building knowledge and systems. He's been inspired to help people have technical access to manage their credit and finances.

Griggs, an African American, is a pioneer among a growing number of techno-preneurs looking to harness the communication prowess of digital media and platforms to help put Blacks and wealth seekers on the road to affluence. He has developed The Good Stewart (TGS) financial system to help those seeking more control and also to understand the ways to improve their credit score and overall wealth.

It should be obvious individuals can't beat systems by themselves so financial literacy should evolve beyond just having insights on getting a mortgage, Debt to Income (DTI) ratios, and investing in stocks and bonds. Financial literacy for Blacks should also extend to new technical tools, political, social, and economic advocacy to gain more economic empowerment and collective wealth creation.

Timothy Griggs, a Black real estate investor and mortgage broker is extremely concerned about Blacks and other financially marginalized people getting access to wealth building knowledge and systems. He's been inspired to help people have technical access to manage their credit and finances.

Griggs, an African American, is a pioneer among a growing number of techno-preneurs looking to harness the communication prowess of digital media and platforms to help put Blacks and wealth seekers on the road to affluence. He has developed The Good Stewart (TGS) financial system to help those seeking more control and also to understand the ways to improve their credit score and overall wealth.

Let's review a small synopsis of systemic racism in the past and moreover - present times that contributes to the lack of Black wealth. Let's touch on some solutions beyond the typical ones floated to develop more Black economic development...

Video & Article On Story Continues After Sponsor's Message Below...

Please Support Our Ad Sponsors Who Make This Community News Blog Possible. And Don't Forget To Tell Them You Saw Their Ad in The Scoop!

-------

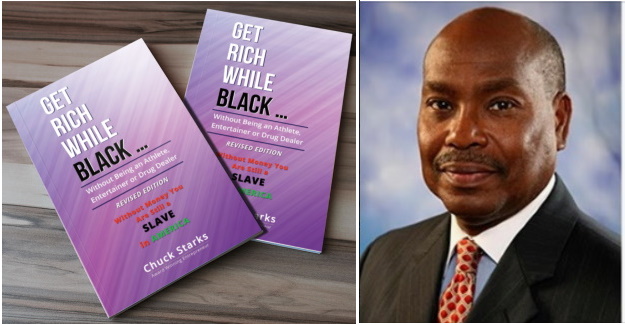

Are You Ready For Financial Freedom? Then...

Without Being An Athlete, Entertainer, or Drug Dealer

"Without Money You

Are Still A Slave In America"

Are Still A Slave In America"

Black wealth is only 10% of white wealth now. Do you know Black wealth is projected to have a median income of zero by 2053?

How can we survive a global economic crisis driven by the Coronavirus with little wealth to fall back on? Get the scoop on how highly successful entrepreneur Chuck Starks, who built one of the fastest growing US businesses, looks to show us how to survive economic downturns in his Revised Edition of his ground breaking book: "Get Rich While Black... Without Being An Athlete, Entertainer or Drug Dealer".

Topics Discussed:

- Reparations to Black Americans

- New NCAA Ruling that allows Black Student-Athletes to Get Paid

- Education and Black American Prosperity

- Age Comparison of Black Millionaires

- Chances of Becoming a Black Millionaire

- Other Races Prospering in America

- White Supremacy and White Dominance

- Rich Black Men Marrying White Women

- Black Student Loan Debt

- Black Business Success/Failure

- The Real “BIG LIE” in America

And of Course, “How to Get Rich While Black…”

This book is a must-read for all Black Americans and can be purchased at all major book retailers (Amazon, Goodreads, Walmart, others).

Parents make sure your children have a copy of this book and they will have a much better chance of being financially successful in America.

YOU DESERVE TO “BE” RICH WHILE BLACK…$$$

Where to Order? The book is available to order a copy on Amazon

Checkout My Exclusive Interview with Author Chuck Starks Click Here

-------

Article On New Insights And Tools To Empower Black Economic Growth Continues Below...

Article On New Insights And Tools To Empower Black Economic Growth Continues Below...

|

| Photo Credit Tachina Lee On Unsplash |

It is hard to catch-up in the race for wealth when - today, the average white high school graduate and also even high school drop-out makes more income than Black college graduates. Furthermore, Black college grads accrue more debt paying for their education.

Rolling Out quotes a study from The New School. It claims "A comprehensive study completed by researchers at the New School titled “Umbrellas Don’t Make it Rain: Why Studying and Working Hard Isn’t Enough for Black Americans” is debunking the myth that "classism is the new racism." The research comes to a shocking conclusion for many African Americans and others of color: the average white high school drop out earns more than the average Black college graduate."

There is over an annual $20,000 difference between Black family and white family income. For instance according to Pew Research "As of 2020, black families have a median household income of just over $41,000, whereas white families have a median household income of more than $70,000."

What are some of the reasons for this wealth disparity? Obvious reasons for the wealth discrepancy is hundreds of years of slavery, share cropping, and Jim Crow discrimination. But there are also less known racial procedures and reasons.

There is over an annual $20,000 difference between Black family and white family income. For instance according to Pew Research "As of 2020, black families have a median household income of just over $41,000, whereas white families have a median household income of more than $70,000."

What are some of the reasons for this wealth disparity? Obvious reasons for the wealth discrepancy is hundreds of years of slavery, share cropping, and Jim Crow discrimination. But there are also less known racial procedures and reasons.

Like how white veterans were given access to capital to buy homes after WW2, that wasn't given to Black veterans. Moreover, whites were given large amounts of land in the US that is now worth billions.

Blacks until very recently didn't receive reparations. Actually, some whites where given reparations for slavery in the past. This is because Blacks were considered property and that whites with warped reasoning were losing their income and perceived human property. The isolated reparations given today are very limited to some small counties and mainline churches in the US.

Blacks even with credit scores as good as whites were ironically targeted with predatory loans. Prosperous Black towns like Greenwood AKA Black Wall Street, were burnt to the ground, residents terrorized, property taken, or killed in places like Detroit, Ocoee, Florida, and St. Louis. Cities even used eminent domain laws to displace Blacks from high value real estate in Manhattan Beach, California, and also Central Park, New York.

Blacks pay hundreds of billions of dollars in taxes a year but less than 2% get Federal government contracts. Blacks with corporate and government jobs pay in the neighborhood of a hundred billion dollars in investments like 401Ks and pension plans but less than 1.5% of Blacks get access to capital from angel investors or more importantly venture capital firms that use pension fund money.

And I haven't even mentioned robbing Black banks like the Freedman Bank. There are today 2.6 million Black businesses but over 90% are sole proprietorships with no employees. Most Black businesses, like many small businesses, complain it is hard to get access to capital.

In the history of the stock market only 13 Black companies have ever gone public. Today only 8 Black businesses have gone public out of 3,671 or only 0.22% according to a report by Investopedia.

Blacks until very recently didn't receive reparations. Actually, some whites where given reparations for slavery in the past. This is because Blacks were considered property and that whites with warped reasoning were losing their income and perceived human property. The isolated reparations given today are very limited to some small counties and mainline churches in the US.

Blacks even with credit scores as good as whites were ironically targeted with predatory loans. Prosperous Black towns like Greenwood AKA Black Wall Street, were burnt to the ground, residents terrorized, property taken, or killed in places like Detroit, Ocoee, Florida, and St. Louis. Cities even used eminent domain laws to displace Blacks from high value real estate in Manhattan Beach, California, and also Central Park, New York.

Blacks pay hundreds of billions of dollars in taxes a year but less than 2% get Federal government contracts. Blacks with corporate and government jobs pay in the neighborhood of a hundred billion dollars in investments like 401Ks and pension plans but less than 1.5% of Blacks get access to capital from angel investors or more importantly venture capital firms that use pension fund money.

And I haven't even mentioned robbing Black banks like the Freedman Bank. There are today 2.6 million Black businesses but over 90% are sole proprietorships with no employees. Most Black businesses, like many small businesses, complain it is hard to get access to capital.

In the history of the stock market only 13 Black companies have ever gone public. Today only 8 Black businesses have gone public out of 3,671 or only 0.22% according to a report by Investopedia.

Presently, only 43% of Blacks own a home (down from 50% before 2008). Furthermore, the real estate of Black homeowners is often devalued by an average of $48,000 a unit in comparison to similar white owned real estate compounding to a $156 billion dollar shortfall in wealth or equity according to research from the Brookins Institute.

In other RE studies like an undercover study in Long Island, New York, by Newsday newspaper: Blacks are still discriminated against in buying real estate. Note this is even in a northern area like Long Island, New York.

In other RE studies like an undercover study in Long Island, New York, by Newsday newspaper: Blacks are still discriminated against in buying real estate. Note this is even in a northern area like Long Island, New York.

So no way is there an even playing field when it comes to starting small businesses or buying real estate in the US to help build wealth. That's a myth.

This has contributed to a wealth gap where whites have about 8 to 10 times the wealth of Blacks (depending on the study). For instance a headline on the Forbes website posted on June 18th, 2021 by Palash Ghosh, featured a headline "Black Americans Earn 30% Less Than White Americans, While Black Households Have Just One-Eighth Wealth Of White Households." I've read white wealth in the US is over $103 trillion dollars while Black wealth is a few trillion.

And now very successful Blacks with advanced degrees can't buy homes because in part they have high student loan debt. This is the situation after selling us the dream that going to college was the pathway to financial success.

Black Median Wealth By 2053 Is predicted to be zero. A Black Enterprise, article stated "You can have a glamorous six-figure salary, advanced degrees, and an executive title at a large corporation and still be impacted by the negative net worth virus that is prevalent in black communities. According to The Road to Zero Wealth report published by Prosperity Now and the Institute for Policy Studies, the median wealth of black Americans will fall to zero by 2053 if current trends continue."

It seems to me financial literacy for Blacks has to go beyond saving and investing in the stock market. It is to realize the systemic marginalization of Blacks economically in this country and to collectively work together to build viable Black businesses with crowd equity investment funding, supporting Black banks, starting Black stock markets and utilizing smart technology tools like The Good Stewart (TGS financial system).

Timothy Griggs, the founder of TGS, is moved to create an evolving and innovative tech solution in the form of a mobile app. The TGS mobile app excels in analyzing and managing current credit and wealth creation endeavors.

Checkout TGS Founder Timothy Griggs' Insights

About Using His Financial App to

Manage And Develop Your Financial Stability...

About Using His Financial App to

Manage And Develop Your Financial Stability...

Sure there is an increasing number of Black billionaires and millionaires. There are about seven (7) billionaires and about a million Black families with a net worth of a million dollars. However, this is a very small percentage of Black people who have this affluence. There are presently over 15 million Black families in the US (about 41 million Black people).

Despite these sobering statistics innovative tools like TGS financial system can give us insights and a handle on uplifting our financial futures.

Timothy Griggs', Good Steward Financial System, is developed to help Black, poor or low income, and aspiring wealth builders navigate the challenging credit and financial algorithms and systems along the path of decreased debt and towards the direction of wealth creation. The Good Steward Financial System (TGS financial System) can help you with the following functionality:

- Manage your credit cards by accessing your credit profiles and financial accounts

- Calculate your debt to income ratio with the TGS platform's tool to help analyze and control your debt.

- Monitor your credit rating with access to the various TGS tiered programs connecting to the credit bureaus

- Review your spending habits

- Protect your identity and digital profiles with the TGS Financial System's Identity Restoration Service

Timothy Griggs, obviously has very ambitious and insightful plans to make his TGS Financial System, even more impactful in helping others reach financial success. He is even developing a debit card that will help people build their credit scores. Learn more about how this insightful financial tool by visiting the TGS financial system.

Thankfully, in addition to having cutting edge tools like the TGS financial system, our mindset and strategies are also changing. For example in NYC we decided to start voting in people committed to economic development for Black people. One Black construction firm got a contract for $30 million dollars another got a contract for tens of millions of dollars rebuilding our 2 major NYC airports.

This is a Black business that got amongst other things a $30 million dollar construction contract to rebuild one of the large NYC airports. This happened because Black activists and media like ours pushed politicians to give Black companies major contracts.

Former Mayor Maynard Jackson, did a similar thing in Atlanta and that is why in ATL you have a large successful number of Black businesses. There is even in Chicago, a Black stock market called the Dream Exchange emerging.

With Blacks having less than 4% wealth in the US shouldn't we be primarily concerned with our ethnic group getting economic opportunities. This is essential especially because our communities have been abused and economically marginalized for 400 years?

I feel for far too long we've often enriched everyone else but ourselves. And new insights, attitudes, and tools can help us turn the tide away from poverty.

Writer's Bio: Writer Kamau Austin, is the award winning Publisher of the Black News Scoop and Scoop Publications, a division of AMS Digital Media. He is a long time activist, entrepreneur, and author. Austin has been featured in Black Enterprise, Fortune Magazine Small Business, CNN, radio, cable, and countless newspapers and blog sites.

----------

Sponsor's Message

Sponsor's Message

IMPROVE AND MANAGE YOUR CREDIT SCORE

"Building Your Credit Can Put You On The Path To Obtain Wealth"

Learn How The Good Steward App Can Help You Manage Your Credit In A Timely Manner

Learn More About the advantages of The Good Steward Financial System

-------

About the Minority Business Finance Scoop - is the premier news blog covering minority, black, and emerging businesses and how they develop and finance their companies. The publication is dedicated to showcasing the business and economic development of Black businesses and entrepreneurs of color.

No comments:

Post a Comment