Friday, December 23, 2022

Discover How The High Tech Dream Exchange Looks To Become The 1st Black-Owned Stock Exchange

Thursday, December 22, 2022

Get The Scoop On How Business Leader Phil Andrews Brings 100 Black Men Of America Inc. To Eastern NY

100 Black Men of Eastern New York, Inc.

Charter Membership

He is also the Founding President of the African American Small Business Foundation, Inc. which supports the programs and activities of the Long Island African American Chamber of Commerce, Inc. The foundation is a 501 c 3 tax-exempt organization.

Friday, November 4, 2022

United States Black Chambers, Inc. Names New York State's Largest Black Chamber LIAACC Spoke of the Month August 2022

Monday, August 29, 2022

Checkout How Dr. Cameka Smith Helps Raise $1.5M in Funding for Black Woman-Owned Businesses

Dr. Cameka Smith, CEO and Founder of The BOSS Network, an online community of professional and entrepreneurial women who support each other through digital content, programs, and event-based networking, continues to support the success of Black women entrepreneurs as it celebrates its 14th anniversary.

In addition, she has partnered with Sage, the global market leader for technology that provides small and medium businesses with the visibility, flexibility, and efficiency to manage finances, operations, and people, for the launch of the Sage “Invest in Progress” Grant Program, a $1.5 million dollar commitment to Black woman-owned businesses for over three years.

As Black business ownership continues to grow in the U.S., Black women entrepreneurs are experiencing an increasing rise despite a challenging economic forecast.

Smith launched the organization to promote and encourage the small business spirit and career development of women of color. Under Smith’s leadership, The BOSS Network (which stands for “Bringing Out Successful Sisters”) has become one of the fastest-growing women’s communities.

Wednesday, July 27, 2022

Do Blacks Need New Insights And Tools To Empower Them For Economic Growth?

|

| Photo Credit Christina at Upsplash |

For instance the following are some stereotypical tropes perpetuated by Black conservatives or financial coaches about the lack of Black financial success:

- Blacks can't achieve financial literacy because we're trying to achieve acceptance with consumerism.

- Blacks don't achieve wealth because we don't understand investments and buy real estate.

- Blacks aren't knowledgeable or disciplined in terms of credit.

It should be obvious individuals can't beat systems by themselves so financial literacy should evolve beyond just having insights on getting a mortgage, Debt to Income (DTI) ratios, and investing in stocks and bonds. Financial literacy for Blacks should also extend to new technical tools, political, social, and economic advocacy to gain more economic empowerment and collective wealth creation.

Timothy Griggs, a Black real estate investor and mortgage broker is extremely concerned about Blacks and other financially marginalized people getting access to wealth building knowledge and systems. He's been inspired to help people have technical access to manage their credit and finances.

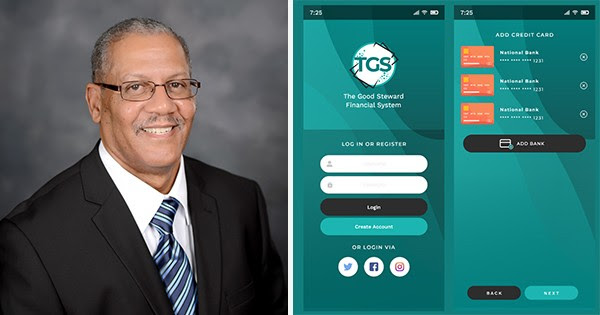

Griggs, an African American, is a pioneer among a growing number of techno-preneurs looking to harness the communication prowess of digital media and platforms to help put Blacks and wealth seekers on the road to affluence. He has developed The Good Stewart (TGS) financial system to help those seeking more control and also to understand the ways to improve their credit score and overall wealth.

Let's review a small synopsis of systemic racism in the past and moreover - present times that contributes to the lack of Black wealth. Let's touch on some solutions beyond the typical ones floated to develop more Black economic development...

Tuesday, July 19, 2022

Learn How Timothy Griggs Developed The TGS App To Demystify And Manage Your Credit Score

Griggs is the Founder of The Good Steward, financial system (TGS), a mobile app that helps subscribers keep on top of their financial affairs. He is a mortgage broker with over 20 years experience and real estate investor. And his tech innovation is a timely tool for those looking to drive insightfully on the road to financial success.

Griggs often alludes to the fact that whether you are looking to buy your 1st home or rental properties you have to watch your debt-to-income ratio (DTI). Of course developing a good debt-to-income ratio is essential to utilizing a viable credit score and therefore geared towards buttressing financial success for most of us in the process.

First-Ever Black Business All-In-One Mobile App

Kyle D. Amaker, founder and CEO of Go Black Own, LLC, which specializes in Internet-related services and products for Black-owned businesses, has made history with the launch of an all-in-one mobile app to help support and foster Black entrepreneurship.

The native app provides supporters and Black-owned business owners nationwide with a centralized platform that easily enables them to do business together. The app can be downloaded for free Apple IOS App Store and Google Play Store.“This is a platform built for us, empowered by us,” says Kyle. “No other platform on the market offers this combination of features. It is simply different.”

Former Undocumented Black Teen Tanya Taylor, Who Built Over $1M in Retirement, Now Teaches Others

Tanya Taylor is the Founder & CEO of Grow Your Wealth, a financial education platform that teaches professionals how to ditch bad debt and create a 6 or 7-figure retirement income even if they don’t have any plans in place.

Tanya is a Certified Public Accountant and holds an MBA in Strategic Management. She has spent most of her 23+ year career on Wall Street, working for or with some of the largest international banks and insurance companies in the world. She has been able to grow her retirement portfolio to over $1 million by age 48 while traveling to over 50 countries.Tanya is no stranger to financial hardships. At 16, she graduated high school without any prospects of a job or higher education. After graduation, she boarded a flight to America, leaving her entire family in Jamaica in the hopes of escaping poverty.

Seeing people living paycheck to paycheck was a sharp contrast to what she had heard about America, but she was undaunted and continued to push towards her goals of building wealth and helping others do the same.

Friday, June 24, 2022

Discover How The TGS Financial System's Mobile App Looks To Reboot The Road To Wealth

Less than 10% of Americans are millionaires. About 79% of millionaires claim they didn't obtain their wealth from an inheritance. According to the National Study Of Millionaires, the largest study of its type, only 21% of millionaires in the US received inheritances.

According to CNBC about 8.8% of all Americans are millionaires (or about 20.27 million Americans) . Since only 8.8% of Americans are millionaires this begs the question: how can the other 91.2% of Americans get on the path to wealth creation?

These certainly are sobering statistics to reflect on given the increasingly problematic nature of obtaining affluence in our country. However, entrepreneur Timothy Griggs, has developed an innovative and high-tech system to help most of us achieve financial viability and put us on the road to wealth creation in the United States.

Griggs has an extensive background of over 20 years in real estate investing and is also a mortgage broker. This positions him as an excellent resource since 90% of millionaires in the US invest their money in real estate. Learn more in the video below...

Tuesday, April 19, 2022

LI African-American Chamber Launches Free Counseling To Help LI, NYC Companies Qualify For Funding

|

| LIAACC President Phil Andrews |

Many small businesses owned by African-Americans and companies in general face difficulties getting loans, despite strong sales. They may face paperwork problems, insufficient accounts, lack of data, liens, unpaid debts or have owners with credit trouble. As a result, a good company may do badly when it comes to getting financing even from a willing lender. Now there’s a new source of help in overcoming these obstacles for minority-owned and other businesses seeking funding.

The Long Island African-American Chamber of Commerce (LIAACC) has used a portion of a grant to help small business owners to hire TMI & Partners, led by Alvin Hartley, to provide free counseling and assistance to African-American owned and other businesses in Nassau, Suffolk, Queens and Brooklyn to obtain funding.

The idea is to give them the help they need to resolve issues and bridge the funding gap that too often stands between small businesses and the funds they need to launch, survive and grow.

Monday, April 18, 2022

Cameka Smith, the award-winning entrepreneur and founder of The Boss Network, an online community of professional and entrepreneurial women, has announced the 35 awardees of the 2022 Sage Invest in Progress grants to support Black women entrepreneurs in their first five years of business. Each of them will receive $10K in funding and a year-long mentorship.

The Sage Invest in Progress grant is a three-year, $1.5 million commitment by Sage (via the Sage Foundation) to support the newly announced BOSS Impact Fund, which is focused on investing in Black women-led businesses and preparing entrepreneurs to build scalable, growth aggressive companies. The goal of the BOSS Impact Fund is to raise investment funding for 500+ black women entrepreneurs over the next three years.

Initially scoped to award 25 grants, the overwhelming response of more than 12,500 applicants nationwide encouraged Sage and The BOSS Network to expand the program with 10 additional grants in the Sage Invest in Progress program. These 35 awardees represent entrepreneurs from around the country and in various industries, including Beauty & Self-Care, Consumer Goods, Professional Services, Healthcare/Wellness, and Food and Beverage.

Saturday, March 19, 2022

1st Black Woman-Owned Self-Sustainable Container Home Manufacturing Facility

Tamika Shari Bond, is founder and CEO of Bond Containers, the first-ever Black woman-owned self-sustainable container home manufacturing facility. This is in a bid to provide clients with homes that are strong, affordable, and self-sustainable.

It is common knowledge that there is a high demand for homes that are both safe and affordable. With issues such as the pandemic alongside other circumstances, this has only been a dream for some people. Bond Containers is however set to make this dream come true.

The construction company is set to build homes that are strong, affordable, and stylish. With Bond Containers, clients will be getting homes that are not only affordable but also features an off-grid backup system in the event of a natural disaster. These affordable modular homes that can be built in as little as 3-4 weeks are part of Bond Containers' goal to join in the global modular construction market size that is expected to reach $175.2 billion by 2025.

Monday, February 7, 2022

$500K Scholarship For Black Women Entrepreneurs

Award-winning entrepreneur Dr. Velma Trayham has launched a $500,000 scholarship fund to support Black women entrepreneurs across the country. The fund, which is a part of her upcoming Millionaire Mastermind Entrepreneur Accelerator Program this spring, is being offered by means of Dr. Trayham's Millionaire Mastermind Academy and her company, Thinkzilla Consulting Group.

The accelerator program provides extensive mentoring, business training, and access to funding growth opportunities for minority business owners and has helped more than 7,000 women nationwide gain the education they need to succeed in business. The accelerator program runs from March 8th through June 14th and is available online or in-person in Scottsdale, Ariz.

Scholarship and program applications are now being accepted here. The Millionaire Mastermind Academy has previously awarded $60,000 in scholarships and more than $30,000 in seed funding to help women entrepreneurs create successful sustainable business enterprises.

“We are thrilled to support even more women entrepreneurs in furthering their education to grow their businesses,” said Lexi Applequist, program coordinator for the Millionaire Mastermind Academy. “In our upcoming program, we look forward to bringing together minority women from across the country to take control of their financial futures and make a profound impact on their communities, families, and businesses.”

Monday, January 31, 2022

$10,000 Grants Available for Black Women Entrepreneurs From The BOSS Network's Capital Program With Sage

|

“Invest in Progress” Grant Program to Benefit Black Women Entrepreneurs

The deadline to apply is February 25th

The BOSS Network, an online community of professional and entrepreneurial women who support each other through digital content, programs, and event-based networking, announces its BOSS Impact Fund.

It has been reported that the single greatest barrier to success for new businesses and startups is access to capital—and minorities make up less than 1% of founders that receive that investment. The BOSS Impact Fund will focus on investing in Black women-led businesses and preparing these entrepreneurs to build scalable, growth aggressive companies. Its goal is to raise investment funding for 500+ Black women entrepreneurs, over the next three years.

As part of its efforts, The BOSS Network is partnering with Sage, the global market leader for technology that provides small and medium businesses with the visibility, flexibility, and efficiency to manage finances, operations, and people, for the launch of the Sage “Invest in Progress” Grant Program, a $1.5M commitment over three years. Sage and The BOSS Network are working together to remove the barriers that many entrepreneurs face by providing funding to support Black women entrepreneurs in the first five years of their business.